Finlytix AI

Your customers are telling you what's broken. Are you listening?

Convert unstructured customer feedback into operational intelligence. See which product issues are bleeding customers and revenue - and the exact technical or process failures causing them. Know where competitors are outpacing you. Fix it before the damage hits your P&L.

BFSI product intelligence that identifies failing features, extracts root causes from customer voice, and delivers engineering-ready fixes.

Financial institutions collect millions of product reviews, NPS scores, and complaint tickets, but the data remains noise. Teams end up reacting to symptoms instead of root causes, leading to avoidable churn, rising costs, and growing regulatory risk.

Finlytix analyzes thousands of reviews to identify failing product features, diagnose the technical or operational root cause, and benchmark against competitors. You see what's breaking, why it's happening, and what will fix it - before it becomes a crisis. Delivered as intelligence reports or ongoing monitoring - whatever your team needs to act fast.

“Only 4% of companies can systematically link customer feedback to business outcomes.”

— Gartner, Customer Experience and Customer Analytics Research

Product Leaders

Stop guessing what to build.

Finlytix ties every complaint to the exact product issue and ranks them by business impact. Your roadmap becomes clear and defensible.

Finance & Business Heads

NPS fell. Churn rose. But why?

Finlytix shows which issues are costing you customers and quantifies the financial hit. You invest where impact is real.

CX & Support Leaders

Your team resolves the same problems thousands of times. Finlytix uncovers hidden patterns across tickets and reviews and exposes systemic issues leadership cannot see until it becomes costly.

Know the "Why", Not just the "What"

Every missed insight costs more than Finlytix ever will.

Finlytix Executive Intelligence Report

One-Time Strategic Intelligence Report for BFSI Leaders

Customer-voice intelligence from large-scale unstructured data

Root-cause analysis of product, journey, and service failures

Competitive benchmarking across key peers

Executive synthesis of risks and priorities

20–30 page executive-ready research brief

Delivery

Single company research brief (includes root-cause analysis and competitive benchmarking)

Delivery: 6 weeks from kickoff. Contact for pricing.

Fast, decision-ready clarity for product and CX leaders before major investments or product decisions.

Finlytix Intelligence Advisory

Ongoing Intelligence & Decision Support

6 Months continuous monitoring of customer and operational signals

Monthly intelligence briefs on shifts and emerging risks

Root-cause insights tied to product and CX ownership

Early-warning indicators with prioritized actions

Quarterly leadership reviews focused on priority shifts

Delivery

Ongoing intelligence advisory (up to 3 products, includes root-cause analysis and competitive benchmarking).

Runs 6 months. Contact for pricing.

Ongoing, decision-grade intelligence for product and CX leaders who treat customer and operational signals as a continuous strategic advantage.

Buried insights cost you.

Finlytix doesn’t.

Share your details and we will take you through how Finlytix identifies emerging issues and failure drivers in your product space using current data and intelligence models.

© Finlytix. All rights reserved.

Reimagine BFSI Intelligence with Contextual AI

Finlytix converts large scale unstructured customer voice into root cause intelligence, sentiment signals, and competitive insight across cards, banking, lending, UPI, and fintech before issues translate into losses.

Finlytix reveals:

What is breaking across customer journeys

Why it is breaking across process, policy, system, or behavior

Where it creates impact across customer experience, operations, compliance, and risk

Built exclusively for BFSI language, journeys, and regulatory context, not generic AI.

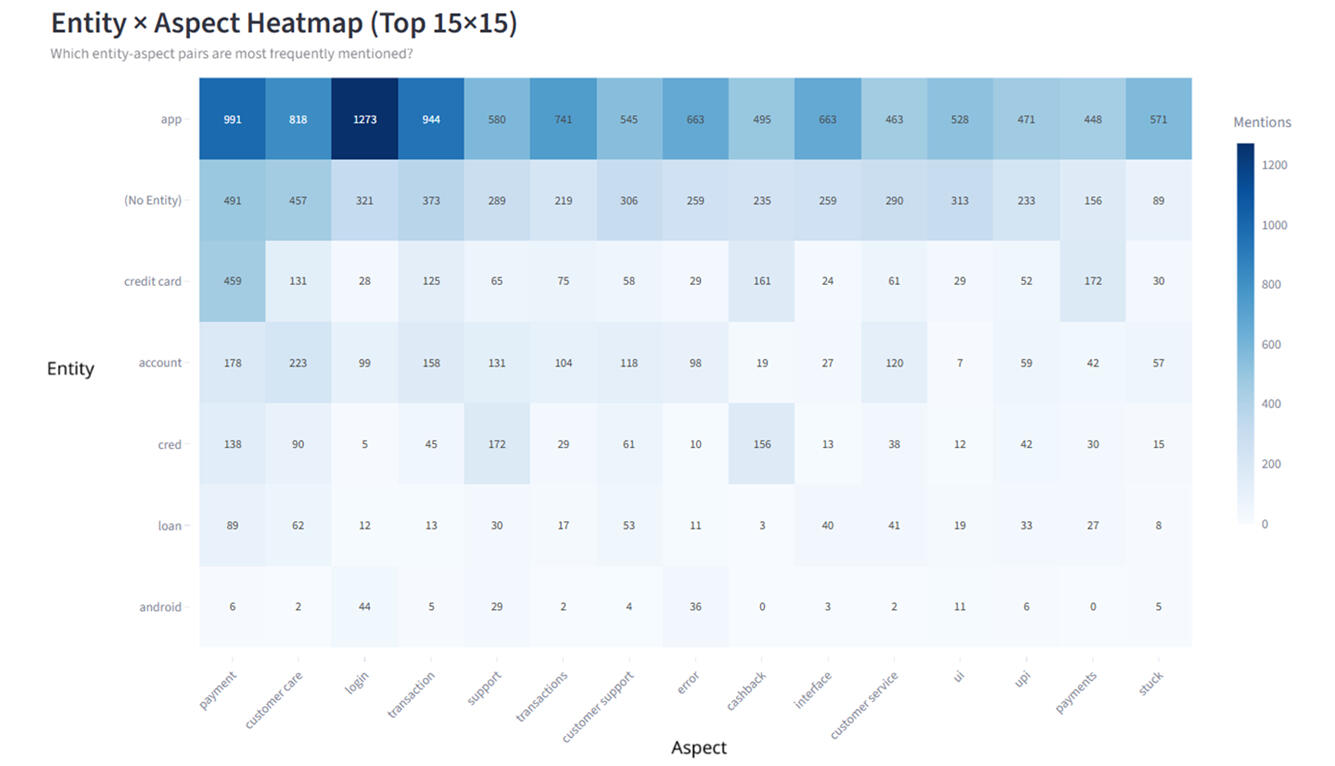

Expose emerging failures early

Finlytix identifies the most active entity–aspect combinations across cards, banking, lending and UPI, surfacing early failure patterns and sentiment shifts long before they appear in complaints or performance metrics.

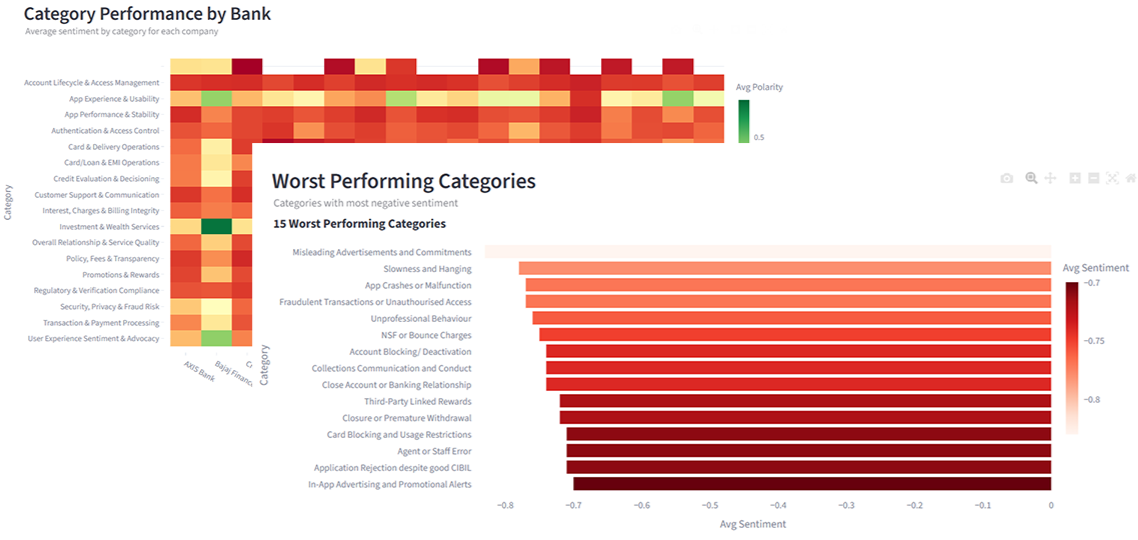

Category Performance & Worst Experience Areas

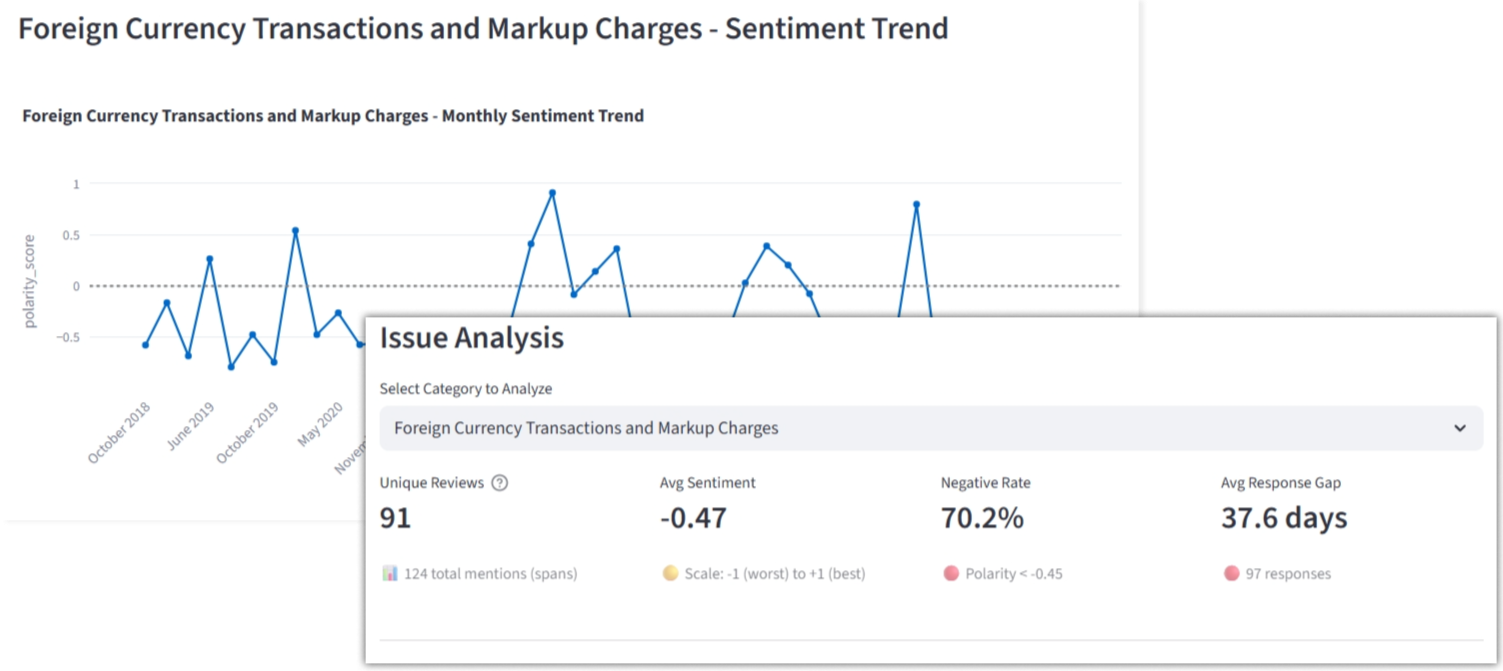

Combined sentiment and polarity reveal which product categories create the most negative customer experiences across banks. The worst-performing areas highlight recurring pain points that need immediate product and service attention.

Hidden Issues, Quantified from Raw Feedback

The Insight Engine surfaces issue-level trends, sentiment shifts, negative intensity and operational gaps directly from unstructured customer feedback. It converts scattered complaints into measurable insights so you can see what’s going wrong, how often, and how it’s changing over time.

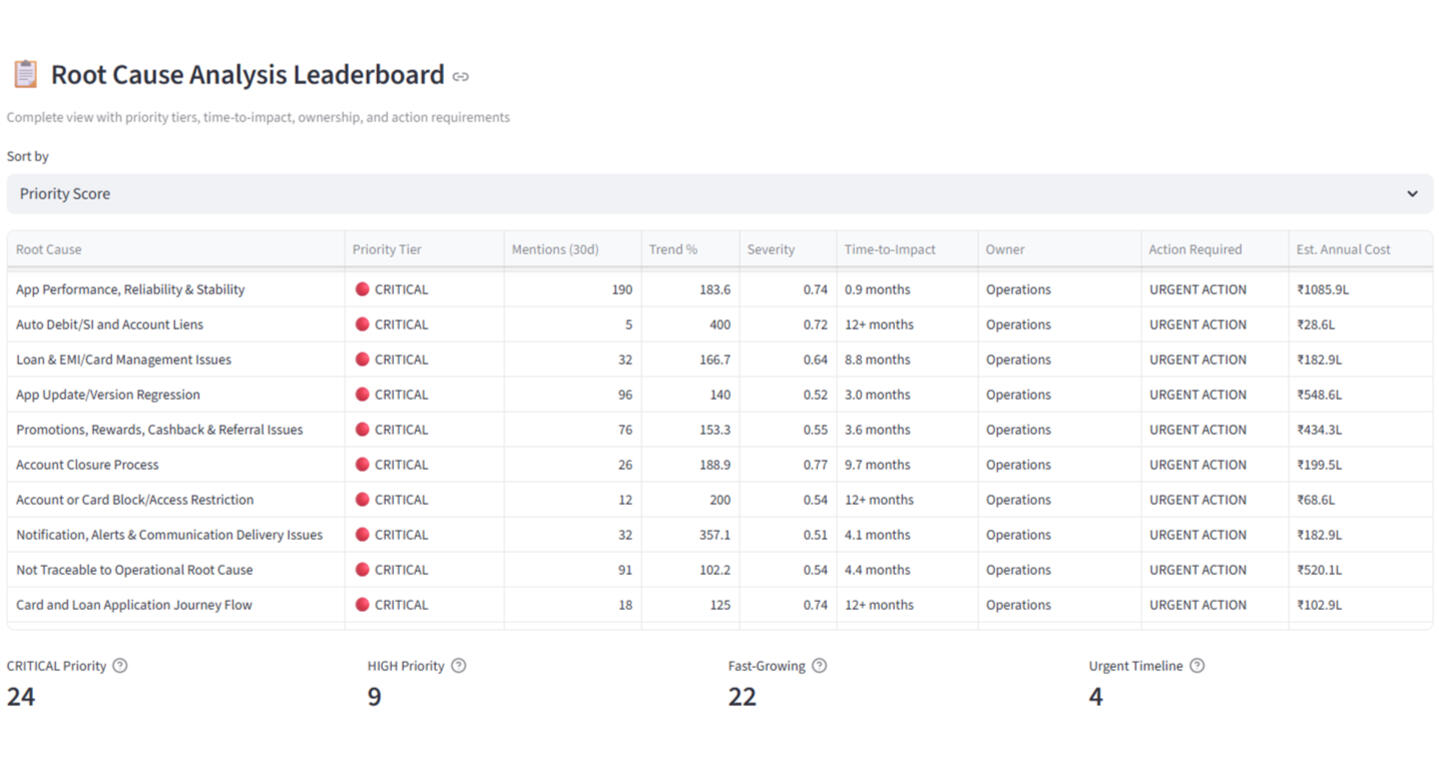

Understand the real failure drivers

Finlytix isolates the underlying product and operational causes driving pain, ranks them by impact and urgency, and shows where action is required rather than just where sentiment is negative.

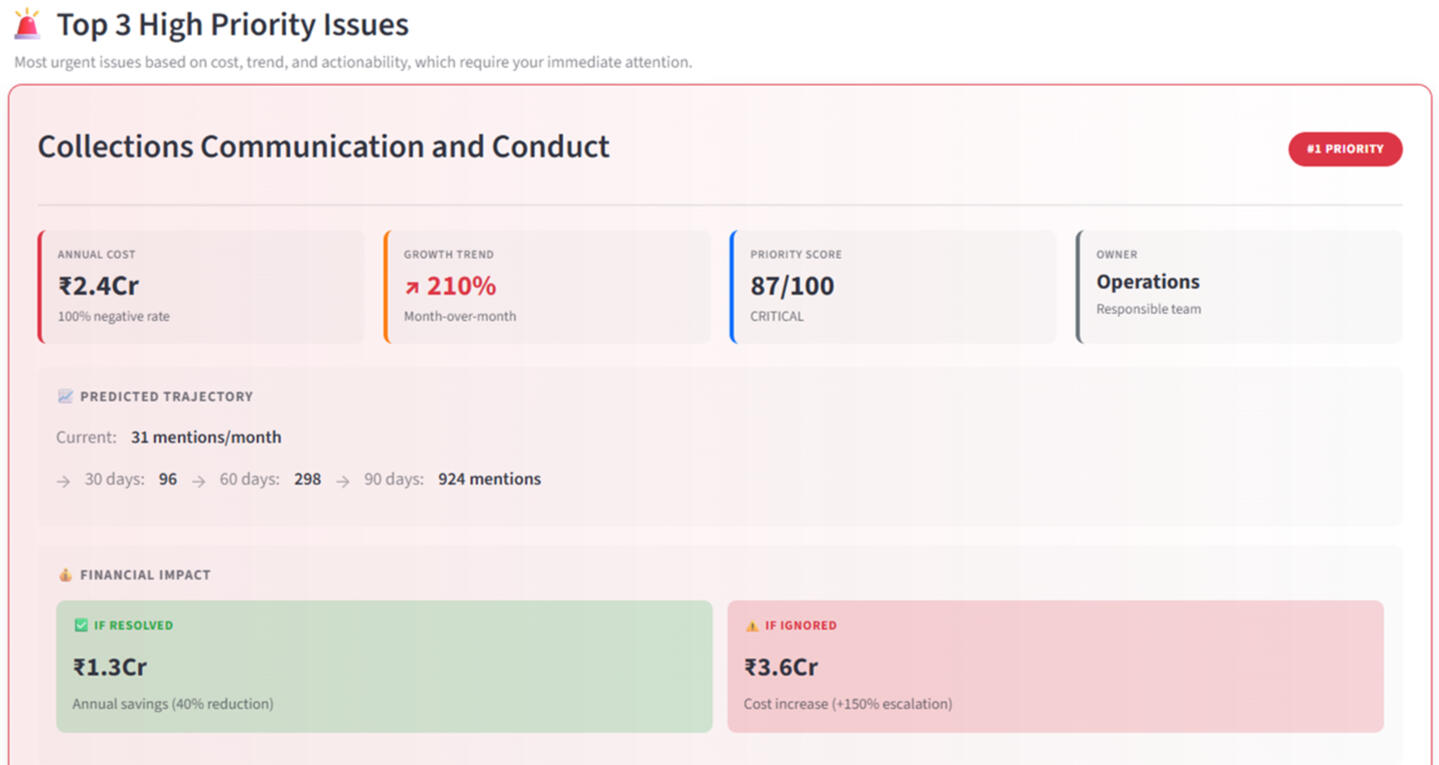

Act on the issues that matter most

Finlytix highlights high-priority problems based on cost, trend and severity, and shows the potential impact of resolving or ignoring them, so teams focus on issues that materially affect outcomes.

Connect → Analyze → Optimize → Act

Data Ingestion & Mapping

Connect all your product and finance data—ERP, payments, subscriptions—and normalize in minutes.

Smart Analytics & AI Insights

Clustering, trend detection, anomaly alerts: identify opportunities and risks before they escalate.

Integrated Reporting & Dashboards

Dynamic dashboards with drill-throughs and embedded forecasts—accessible anywhere.

Buried insights cost you. Finlytix doesn’t.

Share your details and we will take you through how Finlytix identifies emerging issues and failure drivers in your product space using current data and intelligence models.

About Finlytix

Finlytix is a BFSI intelligence engine that converts unstructured customer voice into early indicators of product failure, operational breakdown and competitive pressure. Most banks only see these issues once complaints rise or performance metrics deteriorate; Finlytix detects them at the weak-signal stage by analysing public feedback with models trained on large BFSI datasets.The engine combines domain taxonomies, entity and aspect extraction, aspect-based sentiment, polarity scoring and root-cause mapping to read every review or complaint at product and journey level. This produces a precise view of what is failing, the mechanisms driving it and how the issue evolves across cards, banking, lending and UPI. Signals are monitored over time, compared across brands and interpreted for customer, operational and regulatory relevance.Finlytix is designed around action rather than reporting. Each insight ties back to a specific journey and failure driver, enabling product, CX and risk teams to prioritise issues based on material impact instead of generic sentiment summaries or survey noise.

How Finlytix worksFinlytix ingests public feedback, structures it using BFSI taxonomies, extracts entities and aspects, applies aspect-based sentiment and polarity models, maps root causes and benchmarks signals across products and competitors. The output is an early-warning view that normally appears only after churn, service disruption or regulatory escalation.

Offerings

Finlytix Discovery Stack

Finlytix Intelligence Engine

Who it is forProduct, CX and risk leaders in cards, banking, lending and fintech who need evidence based prioritization and early detection of emerging issues.

Weak signals become problems only when ignored.

Leave your details and we will show how Finlytix surfaces early failure drivers and competitive pressure across cards, banking, lending and UPI.